Introduction: The Changing Landscape of Opportunity Zones and Legislative Impact

Opportunity Zones (OZs) have transformed the approach to economic development, encouraging investors to back projects in underserved areas across the United States. Since their introduction under the Tax Cuts and Jobs Act of 2017, OZs have brought capital to distressed communities while offering tax incentives to investors. However, as OZ investments have grown, so has the need for additional guidance, refinement, and sometimes even extension of the incentives themselves. This is where the proposals in the Improvement and Extension Act comes into play.

While only proposed and still sitting on the floor of the House of Representatives, the Improvement and Extension Act could bring clarifications, adjustments, and, most importantly, extensions to OZ regulations, making the program even more accessible and appealing to investors. Here, we’ll explore the key aspects of this Act, the changes it could introduce if passed, and what it could mean for OZ investors in the coming years.

Section 1: Background on the Opportunity Zone Program and Its Goals

Opportunity Zones were established with the mission to drive investment into areas that need economic revitalization. Here’s a brief recap of how they work:

-

Purpose and Incentives

-

OZs offer tax deferral on capital gains and potential full exclusion if investments are held long-term.

-

Investors can participate by placing their gains into Qualified Opportunity Funds (QOFs) that invest in OZ properties or businesses.

-

-

Initial Limitations and Challenges

-

While beneficial, the program has faced challenges. Investors cited tight deadlines, lack of guidance, and, more recently, the 2026 cutoff for deferrals as concerns.

-

The Improvement and Extension Act proposes responses to these challenges, addressing certain issues to ensure the OZ program achieves its purpose effectively.

-

Section 2: What is the Improvement and Extension Act?

The Improvement and Extension Act (H.R. 5761) is a proposed bill, designed to address issues and extend the lifespan of the OZ program, includes several key components aimed at refining and improving the program’s overall efficiency.

-

Extension of Deferral and Exclusion Periods

-

One of the most significant provisions is the proposed extension of the capital gains deferral period beyond the original 2026 deadline out to December 31, 2028 – giving investors more flexibility.

-

This extension is designed to encourage long-term commitments to OZs, with the goal of maximizing community impact while providing more generous timelines for tax planning.

-

-

Additional Reporting and Transparency Requirements

-

To address concerns about the effectiveness of OZs in community development, the Act mandates increased transparency, requiring QOFs to report more detailed data on their impact.

-

This transparency could benefit both the communities served and the investors, as it helps identify successful strategies and ensures investments are genuinely beneficial.

-

-

New Benefits for Environmental and Sustainable Development

-

If passed, the Act would also introduce incentives for projects that incorporate sustainability and environmental impact, recognizing that long-term viability and community benefit often require green solutions.

-

This is particularly relevant for projects like affordable housing, renewable energy installations, and environmentally friendly construction, which can now see enhanced tax benefits or support.

-

-

Additional Qualified Opportunity Zones

-

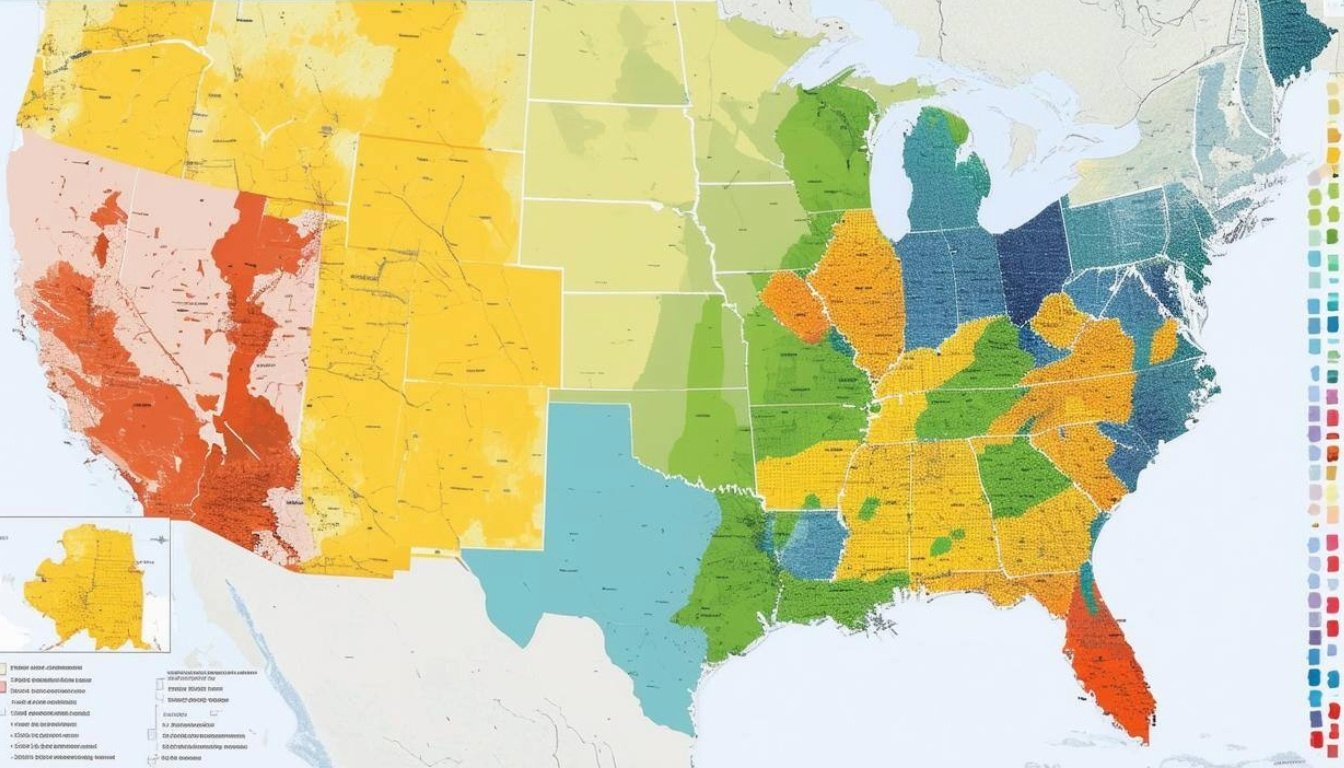

Certain new areas may be designated as OZs to address regions that have recently experienced economic setbacks, making the program more adaptable to shifting economic needs.

-

This addition allows for more geographically diverse investments, ensuring that areas with emerging challenges can benefit from the OZ program.

-

Section 3: Key Changes in the Act and Their Impact on OZ Investments

-

Extended Investment Deadlines

The Improvement and Extension Act, if passed, will extend the period investors have to defer capital gains taxes, originally set to expire in 2026. With the new timelines:-

Extended Deferral Deadline: If passed, investors will have 2 additional years to defer capital gains (out to December 31, 2028), allowing them to engage in more comprehensive development plans without the immediate pressure of tax deadlines.

-

Impact on Investment Strategy: This extension could allow investors to focus on longer-term, larger-scale projects that can make a more profound impact in OZ communities.

-

-

Enhanced Step-Up Basis Opportunities

The proposed Act revisits the step-up basis benefit by offering new milestones or percentages of basis increases based on holding periods. Previously:-

Original Step-Up Basis: If enacted, the act would restore the expired 10% basis step-up for five-year holdings but would not bring back the 5% step-up for seven-year holdings.

-

Revised Basis Increases: With this Act, investors holding OZ investments may receive more favorable step-up opportunities, which could improve returns on longer-held investments.

-

-

Flexible Capital Gains Reinvestment Options

-

The Improvement and Extension Act could broaden the range of capital gains eligible for reinvestment into OZs, which opens doors for investors with diverse asset portfolios.

-

New Eligibility Guidelines: By easing restrictions, the Act may allow investors to tap into OZ benefits from a wider range of asset gains, promoting more fund diversification and potentially higher returns.

-

Section 4: Benefits of the Improvement and Extension Act for OZ Investors

-

Increased Timeline for Return on Investment (ROI)

With extended deadlines, investors could have more time to develop, enhance, and profit from OZ investments. This aligns well with long-term developments, like infrastructure projects, housing developments, and commercial centers that require longer timelines for meaningful ROI. -

Greater Investment Flexibility and Reduced Pressure

The original OZ deadlines created a sense of urgency, potentially leading investors to prioritize quick wins over impactful investments. The extended deferral and investment periods could allow investors to take a more strategic, thoughtful approach without the stress of a rapidly approaching deadlines. -

Environmental Impact Incentives

Projects focused on sustainable development could benefit from new incentives under this Act. Investors who prioritize environmental consciousness—such as energy-efficient buildings, renewable energy projects, and green spaces—can now enjoy additional benefits, enhancing the attractiveness of these types of projects. -

Potential for Enhanced Returns with Revised Step-Up Basis

The new step-up basis benefits mean that investors can see significant returns on investments held over longer periods. This potential for an increased basis, combined with the possible elimination of taxes on new gains after 10 years, further incentivizes long-term involvement in Opportunity Zones.

Section 5: Challenges and Considerations for OZ Investors

-

Complex Reporting and Compliance Requirements

-

While the added transparency is beneficial, QOFs now face more stringent reporting obligations. These requirements can increase administrative costs and complexity for fund managers, necessitating well-documented processes and possibly additional staffing. Speak to a member of our team if you'd like to explore your options for building, raising, and managing your next QOZF.

-

Investment Strategy Adjustments: Investors and fund managers should be prepared to allocate resources to meet compliance demands without affecting their project timelines.

-

-

Long-Term Investment Risks

-

Possible extended deferral periods mean that investors’ capital may be tied up for longer than initially planned. In fluctuating markets, this could pose a risk, particularly if economic conditions in the OZ change.

-

Risk Mitigation Strategies: Investors are encouraged to conduct thorough due diligence, underwriting, and consider local economic factors to ensure their projects are sustainable over time. Our team meticulously evaluates each Opportunity Zone project to confirm both market viability and the potential for project-level success.

-

-

Environmental Incentives May Require Specialized Expertise

-

Projects aiming to take advantage of the environmental incentives may require technical expertise or additional project planning, which could increase upfront costs.

-

Solution: By collaborating with specialists in environmental and sustainable development, QOFs can mitigate these challenges and maximize the benefits of environmentally focused projects.

-

Section 6: Future Outlook – How the Improvement and Extension Act Could Position OZs for 2025 and Beyond

-

Sustained Growth in OZ Investments

-

By extending timelines and providing enhanced incentives, the Act aims to sustain growth in OZs, attracting a new wave of investors who are now reassured of the program’s longevity.

-

Impact on 2025 Investments: With fresh momentum, OZs are likely to experience a surge in capital as investors recognize the increased flexibility and potential for long-term gains.

-

-

Broadening the Appeal of OZs to Diverse Investors

-

The flexibility introduced by the Act widens the net for investors across asset classes, industries, and regions. This inclusivity could bring innovative and varied projects to OZs, from tech hubs to green manufacturing centers, diversifying the types of investments in these communities.

-

-

Advancing Economic Development Goals

-

The Act enhances the program’s ability to achieve its intended purpose: spurring economic growth in underserved areas. With updated guidelines and more incentives for sustainable projects, OZs are positioned to make a more significant impact on community welfare and economic progress.

-

Conclusion: What the Improvement and Extension Act Means for Today’s OZ Investors

The Improvement and Extension Act represents a proposed pivotal update for Opportunity Zone investors, extending deadlines, introducing additional benefits, and refining reporting requirements to ensure that the program achieves its economic and community-focused goals. For investors, this means greater flexibility, new potential for returns, and the chance to make a positive impact while benefiting from tax advantages.

For those considering OZ investments in 2025 and beyond, the proposed Act provides assurance that the Opportunity Zone program is here to stay and that it offers even more tools for realizing investment success. By staying informed of these changes and aligning strategies accordingly, investors can maximize both the financial and social returns of their Opportunity Zone projects.

If you would like to speak with an Opportunity Zone expert, please contact us.